The above is an overall, "birds-eye" view of the Section 179 Deduction for 2025. Contact us for more details on limits and qualifying equipment.

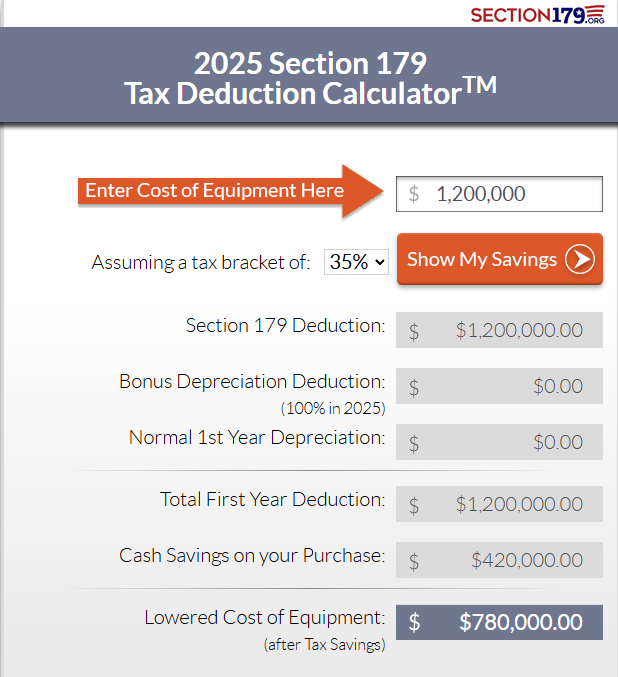

Here is an updated example of Section 179 at work during the 2025 tax year.

What is the Section 179 Deduction?

The Section 179 Tax Deduction is one of the most valuable incentives available to small and medium-sized businesses in the United States. It allows business owners to deduct the full purchase price of qualifying equipment or software that is purchased or financed and put into service during the tax year. For 2025, this means your business can write off up to $2,500,000 worth of qualifying purchases, as long as the equipment is placed in service by December 31, 2025. The intent of this deduction is to encourage investment in businesses by accelerating tax write-offs.

The purpose of Section 179 is to encourage businesses to invest in themselves by purchasing new or used business equipment. Instead of depreciating an asset over several years, businesses can deduct the entire cost in the same year it's placed in service. This helps free up cash flow and allows companies to reinvest in growth.

How Does Section 179 Work?

The purpose of Section 179 is to encourage businesses to invest in themselves by purchasing new or used business equipment. Instead of depreciating an asset over several years, businesses can deduct the entire cost in the same year it's placed in service. This helps free up cash flow and allows companies to reinvest in growth.

Additionally, businesses may still take advantage of 100% bonus depreciation in 2025 for new qualifying equipment. Bonus depreciation can be applied after the Section 179 deduction is used, allowing for even more potential savings. Both deductions together can significantly reduce a company's taxable income and overall tax burden.

For example, if your company purchases $300,000 worth of eligible equipment in 2025 and places it in service before the end of the year, you can elect to deduct the full amount-reducing your taxable income by $300,000, assuming you have sufficient business income. That's immediate savings that can make a big difference for companies looking to expand or upgrade their operations.

Important Considerations & Restrictions

In 2025, the total amount that can be expensed under Section 179 is capped at $2.5 million. Once a business's total equipment purchases exceed $4 million, the deduction begins to phase out dollar-for-dollar and is completely phased out at $6.5 million. This makes Section 179 particularly beneficial for small and mid-sized businesses rather than large corporations.

- The deduction is limited to the amount of taxable income from business activities; losses may require carry-forward.

- If business-use drops to 50% or below in any subsequent year, recapture of part of the deduction may apply.

- Exceeding the total-purchase thresholds will reduce or eliminate the deduction.

- State tax treatment may differ from federal rules; some states do not conform to or limit Section 179.

- Vehicles, listed property, and leased property may have additional restrictions.

- Always consult with your tax advisor to confirm eligibility for your business.

Who Qualifies for Section 179?

To qualify for Section 179, the property must be used for business purposes more than 50% of the time and must be tangible, depreciable, and purchased or financed within the calendar year. Qualifying property typically includes equipment, machinery, computers, office furniture, off-the-shelf software, and certain building improvements such as HVAC systems or fire suppression equipment. Business vehicles may also qualify, though special limitations apply to passenger cars and SUVs.

To take advantage of Section 179, businesses must make qualifying purchases and place them in service between January 1 and December 31, 2025. When filing your taxes, you'll elect the deduction using IRS Form 4562. It's important to maintain proper documentation such as invoices, proof of payment, and evidence that the equipment was placed in service during the year.

Action Checklist for Your Business

- Identify equipment, software, or building improvements your business intends to place in service in 2025.

- Track business-use percentages (≥ 50%).

- Ensure purchases are made and placed in service by 12/31/2025.

- Review financing/lease terms to qualify.

- Work with your accountant to determine the optimal mix of Section 179 and bonus depreciation.

- Maintain documentation and file the proper election on your return (Form 4562).

Additional Information & Resources

Since tax laws change frequently and each business is unique, review the rules annually and coordinate with your tax professional.

The bottom line is that Section 179 provides an excellent opportunity for business owners to reduce their tax liability while reinvesting in their operations. Whether you're purchasing vehicles, computers, machinery, or other qualifying equipment, the deduction can deliver substantial savings for your business.

Always consult with your tax advisor to confirm eligibility for your business. Every company's situation is different, and a qualified tax professional can help ensure that you are maximizing your benefits under the current tax code.

For more detailed information, examples, and calculators to estimate your potential savings, please visit www.Section179.org.

How can we help?

* Indicates a required field